✎ Key Points:

» You can track your Cash App transactions by clicking on the Clock icon in the top right corner to view your past activities.

» Use the app cautiously as banks cannot monitor your Cash App account unless illegal activities are involved; in such cases, tracing is possible.

» If you encounter issues like mistaken transactions or non-receipt, despite completion status, contact Cash App support for resolution.

Contents

Can Cash App Transactions Be Traced?

No normal user can trace a Cash app because people can hide their name or number if they don’t want to show it. But if they do illegal things, then by Law enforcement, their account can be traced.

The average citizen’s privacy depends on municipal, state, province, and country laws. Law enforcement may compel any accounts and their activities; otherwise, no average citizen can trace the Cash app details of other citizens.

Using law enforcement and passing court orders, police officers can easily track any Cash App account, making it impossible for average citizens to have untraceable accounts.

How to track Cash App transactions:

Follow the steps:

Step 1: Open the Cash app and log in

Before talking about the way to find the transaction history, first, you have to log in to your account. Open the Cash app, enter your login credentials, and log in to your Cash app account.

Those who do not have the app can install the app from the Play Store (use App Store for iPhone), and those who do not have an account sign up for a new one.

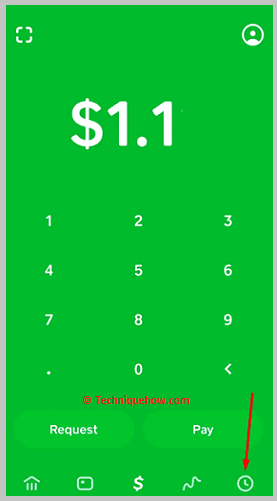

Step 2: Tap on the little Clock icon

After entering the Cash App home screen, you can see the number keypad where you can write the amount you want to pay or request. On this page, you can see a small Cook icon at the top right side, click on it, and you will be redirected to the Activity page.

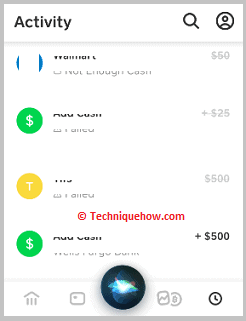

Step 3: Showing your past activities

On that Activity page, you can see all of the past activities that you have done earlier. It will come up with the details of the amount and the date you have done the transaction.

Step 4: Click on the Three dots to get more information

Now to get more information about a transaction, click on it, then click on the Three dots from the top right corner, and click Help to see more details about the transaction.

Can banks track Cash App transactions?

No, as per the law of privacy policies, banks can not track any user’s online transaction. Banks have all the details, but they can not track the transactions legally; if there is any issue regarding your Cash app transactions, they can track your transaction history and report.

In other cases, if policing officials want to know any details legally, they can track your account.

When Your Cash App Can Be Traced:

These are the conditions:

1. If you Have Done Something Illegal

Illegally hackers can trace anyone’s Cash app, but if you have done something wrong with your Cash app, then legally, policing officials can trace your account.

Illegal activities like laundering anyone’s money or on a large scale, if there are any transactions between your Cash app account and any terrorist or due to other suspicions of terrorism funding your Cash app account may be traced.

2. Getting Permissions From Law Enforcement

Your Cash app account can be traced legally using law enforcement and passing court orders.

If you have done something wrong with your Cash app account and if anyone takes any legal action against you, then police officers can pass court orders, and using law enforcement, they can legally track your account.

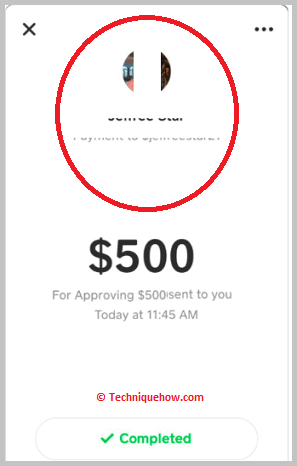

Cash App payment completed but not received:

These may be the reasons:

1. Maybe Sent to a Different Phone number or email address

If sometimes your Cash app payment is completed, but you do not receive the money, there could be many reasons for this glitch.

It may happen that during transactions, you type the wrong phone number or email address; that’s why the money was sent to another user.

It means your transaction is completed, but the actual person does not receive the cash. Other reasons for this situation could be that the debit card you are using is expired, you have insufficient funds, you are exceeding the daily limit, etc.

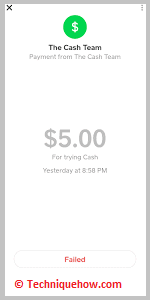

2. Cash App Failed Transaction

Sometimes if the Cash app transactions fail, the amount may be debited from your account, but it is not sent to the targeted person’s account. If it happens, do not worry; they will instantly return your money to your bank account within 1-3 business days.

It may happen if you use the outdated app or the server has any issues (over 26 million people use the Cash app monthly).