Cash App has become one of the most popular mobile payment platforms in the United States, making it simple for people to send and receive money instantly. It allows users to handle peer-to-peer payments, buy Bitcoin, invest in stocks, and manage digital funds with ease. However, a recurring question often appears among its users: “How can I find someone’s phone number on Cash App?” This concern arises from the need for direct communication, transaction verification, and trust building in digital exchanges.

It is worth knowing that Cash App does not provide a direct phone number search feature. Instead, it focuses on privacy and the use of identifiers such as $Cashtags, emails, and synced contacts.

Still, there are legitimate situations where knowing a person’s Cash App phone number becomes essential. For instance, when sending money to a new user or verifying an identity for business transactions, the phone number adds an extra layer of assurance.

Many users think that finding someone’s number is difficult, but the truth is, there are indirect ways to connect through information already stored in the app. This includes reviewing transaction history, checking profile details, syncing contacts, or contacting Cash App support for assistance. Each method works differently, and some depend on whether the other person has chosen to make their contact information visible.

This guide explains how to responsibly find or confirm a Cash App user’s phone number. You’ll also learn why phone numbers matter in maintaining smoother, safer transactions. By following these steps and understanding Cash App’s limitations, you can use the app more effectively without violating its privacy principles. Whether you’re trying to reconnect with a friend, confirm a payment recipient, or organize group transactions, this guide covers everything you need to know about identifying a user’s number within the app.

How To Find Someone’s Number On Cash App

Cash App itself doesn’t directly reveal a user’s phone number unless that person has linked it publicly or shared it with you. However, there are several legitimate methods you can use to find or confirm a number. These include using the app interface, checking transaction history, viewing profile information, syncing contacts, or contacting Cash App support.

1. On the Cash App

You can first try to find someone’s phone number directly within the Cash App. The app links to your phone’s contacts when permission is granted, allowing you to view which of your existing contacts already use Cash App. This feature makes it easier to identify people without typing their $Cashtag or email manually. When your contact list syncs, Cash App displays user profiles associated with phone numbers you already have saved.

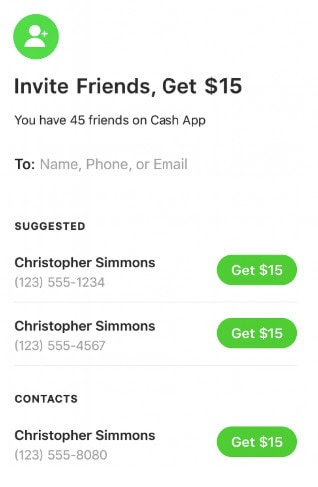

To begin, open the Cash App and navigate to the home screen. Tap on your profile icon in the upper right corner. This leads to your account settings page, where you’ll find the “Contacts” or “Invite Friends” section. Tapping on this option shows your synced contacts. If the person’s number is connected to their Cash App account, their name and $Cashtag will appear here automatically. From there, you can tap the profile to view more details or send money directly.

In several cases, you may not see a number displayed because Cash App protects user privacy by default. Only if the user has made their number visible will it appear. Otherwise, you’ll only see their $Cashtag or display name. It’s also possible that the person hasn’t added a number to their account or is using an alternate one.

This method is the most direct path when the user is already in your contact list.

Step 1: You can open the Cash App on your phone and ensure you are logged in to your account.

Step 2: It’s necessary to tap on your profile icon in the top right corner of the home screen.

Step 3: You can scroll down to find and select the “Contacts” or “Invite Friends” section.

Step 4: This section displays everyone from your phone book who uses Cash App.

Step 5: You can find the person’s name in the list or use the search bar to type their number or name.

Step 6: If their phone number is linked, Cash App will show their details automatically.

Step 7: You can tap on the contact’s profile to open their Cash App account and view related information.

Step 8: In case no phone number appears, you can still use their $Cashtag or email to send money safely.

This process ensures that you connect with the correct person and avoid sending money to the wrong account. You can repeat the same process anytime you update your contact list or install the app on a new device.

2. Old Cash App Transactions

You can often find the contact you need by digging into past transactions on Cash App, which is the easiest option, as you have already exchanged money with someone.

This method works with the app’s activity log, where each payment or request you’ve sent or received is recorded with a date, amount, and a counterparty label.

When that counterparty is tapped, Cash App commonly shows a profile that may include a display name, $Cashtag, email, or phone number, but only if the other user chose to make it visible. This, in practice, means your success depends on prior interaction and the other person’s privacy settings.

This works best for people you’ve transacted with recently or with distinct payments that are easy to identify.

For example, if you paid someone a specific amount for a shared dinner or a utility split, look for that transaction by date or amount. Cash App lists transactions chronologically and lets you scroll back through months of activity. Each line item is a starting point: tap the item, then tap the counterparty’s name or profile icon to see what details are available.

Many users forget that transaction notes and attached messages can also provide clues. If the person added a memo like “concert tix — Alex,” you can match that memo to the contact shown in the transaction. Sometimes the profile revealed from the transaction includes an email or $Cashtag that you can use instead of a phone number. If a phone number is visible, note it down and compare it with your phonebook or other contact sources before using it for a payment. This avoids sending money to the wrong person.

Not every transaction will expose a phone number. Cash App allows users to limit what others see. If the number isn’t shown, you can still message the user within Cash App via the transaction details or use the $Cashtag displayed. Messaging through the app keeps the conversation tied to the transaction and creates a clear record in case of disputes. If necessary, you can request that the person share their preferred contact method through the in-app message.

You can take screenshots of the transaction and any in-app messages as proof of communication or agreement — useful if something goes sideways or if you need to escalate the issue to Cash App support. Keep records of the date, time, and amount; this metadata helps support agents locate transactions faster.

In several cases, transaction details reveal an email rather than a phone number. If that happens, use the email to reach out first and politely request a phone number if needed.

- Open Cash App and tap the activity/clock icon to view transactions.

- Identify the relevant transaction by date, amount, or memo.

- Tap the transaction, then tap the counterparty’s name or profile icon.

- Check for a visible phone number, email, or $Cashtag.

- Use in-app messaging if the phone number isn’t shown, and request contact details there.

3. Profile Information

A Cash App profile typically contains a display name, $Cashtag, and sometimes an email or phone number if the user has added and allowed that information to be visible. Profiles also show profile pictures and basic account information, which help you confirm identity before sending money.

This method is most useful when you have some way to find the user inside Cash App i.e. a name, $Cashtag, or contact synced from your phone. Use Cash App’s search function to locate a profile. Just type the person’s name or $Cashtag into the search bar and scan results for matching accounts.

When you land on a profile, scan for the contact section. If a phone number is listed, it will appear alongside other visible details. Profiles that belong to businesses or creators are more likely to include public contact info.

Many people, however, do not publish phone numbers on their profiles. They prefer email or $Cashtag to preserve privacy, and Cash App honors those preferences.

If the profile looks legitimate but lacks a phone number, use the app’s messaging feature to request it, explaining why you need it and asking for permission to save it.

One practical tactic is to check the profile’s $Cashtag and follow external verification steps: search that $Cashtag on other platforms (social media, business pages) to find matching contact data. Many small businesses and freelancers reuse the same $Cashtag across web profiles, which sometimes include a phone number or website contact form. Always prefer publicly shared business numbers rather than personal numbers when dealing with commerce.

Look for signals of authenticity: consistent spelling, a verified external presence, or transaction history with others that confirms activity. If unsure, send a small test amount (for example, $1) with a memo explaining it’s a verification step; if the recipient returns or confirms receipt, you’ve validated the account. Keep the amount minimal to limit exposure.

One more point: Cash App profiles for businesses sometimes include routing/account features or support emails. Use those if your interaction is commercial rather than personal. Business profiles are typically set up with more public details and are safer to reference for invoices, refunds, or customer service.

- Use Cash App search (name or $Cashtag) to find the profile.

- Compare profile photo, display name, and $Cashtag against what you know.

- Look for visible contact details (phone, email) on the profile.

- Message the user within Cash App to request their phone number if needed.

- Cross-check $Cashtag on other platforms for corroborating contact info.

- Consider a tiny verification payment if identity remains uncertain.

4. Customer Service

You can try Cash App’s customer service when other methods fail or when you have a legitimate reason to request contact details related to a transaction.

Cash App support handles account issues, disputed payments, and safety concerns, and while they won’t hand over someone’s private phone number without cause, they can help mediate problems, confirm transaction recipients, or guide you through safe ways to contact another user.

This is particularly helpful when money is involved, such as unreturned funds, fraud, or chargebacks.

If you suspect fraud, include any suspicious profiles or messages. When you contact Cash App support, having concise, factual documentation speeds up resolution and makes it more likely that support will take action. Cash App support channels include the in-app help center, email, and sometimes phone support for critical issues.

Instead, support can confirm whether a transaction reached an active Cash App account, provide status updates (completed, pending, refunded), and, in cases of fraud, freeze accounts or initiate investigations. If the contact is necessary to resolve a dispute, support may reach out to the other party on your behalf or advise on the appropriate next steps for recovering funds. They can also tell you whether certain details (like a profile or $Cashtag) match the transaction record.

One practical step is to submit a support ticket with the transaction reference and ask for guidance rather than directly demanding private information. Support will then follow internal protocols to verify and, where appropriate, intervene. In situations involving legal concerns or clear scams, they may escalate to their fraud team and, if necessary, cooperate with law enforcement requests, though that requires formal processes.

Customer support processes take time; complex investigations may take days or longer. Keep records of your correspondence with support, note ticket numbers, and follow up politely if you don’t receive timely updates. Use in-app support where possible because it ties your request directly to the account and transaction.

If the situation is urgent, for instance, an unauthorized transaction, then mark the communication clearly as urgent and provide all supporting details at once. Cash App can sometimes reverse pending payments or temporarily limit accounts while investigations are underway.

For business-related disputes, ask support whether they can provide proof-of-delivery options or merchant verification steps.

5. Contact Syncing

You can sync your contacts for finding someone on Cash App by ensuring your phone’s contact list is current and that Cash App has permission to access it.

When contact sync is enabled, Cash App cross-references your phonebook with its user base and shows people from your contacts who have registered on the platform.

This synchronization is the cleanest way to surface a phone number, provided the other person has chosen to link the same number to their Cash App account.

You can update your phone contacts with correct names and numbers, including alternate numbers and emails. If you recently changed a number for someone, save both old and new entries with notes. Then open Cash App, go to settings, and confirm that contact access is turned on. On iOS and Android, granting permission is a one-time system-level setting. Once enabled, Cash App will scan your saved contacts and populate the app’s Contacts or Invite Friends section with matches.

Cash App will show only contacts who have opted into discoverability via their phone number or email. If a contact uses a different number for Cash App than the one you saved, they won’t appear. In such cases, consider reaching out through your normal messaging app to ask which number they use for Cash App, just explain why you need it.

One advantage of contact sync is automatic updates: whenever someone in your address book joins Cash App, they can appear in your list without manual searching. This is especially handy for groups or teams that frequently transact, like roommates or coworkers.

For people who do not want their number visible, sync still allows you to see a linked profile (without a phone number) and to connect via $Cashtag or email.

If you enable contact sync, remember that you’re giving the app access to your entire contact list. This is standard for many social and payment apps, but if you have privacy concerns, you can temporarily enable sync, find the contact, and then disable it. Also, if multiple family members share a phone, consider which contacts are visible in a shared device.

Contact sync is fast, integrated, and typically yields results when both parties keep their contact info current and linked to their Cash App accounts. You can also take a few steps to find who is behind the Cash App.

Why You Need a Phone Number for Your Cash App

It’s important to understand why having or knowing a phone number connected to Cash App can be required. A phone number serves multiple purposes in transaction accuracy, security, verification, and communication. When linked to a Cash App account, it becomes a unique identifier, much like an email address or $Cashtag, ensuring smoother user interactions. Many users rely on it to verify recipients, recover accounts, or communicate directly about pending payments. These functions not only make transactions efficient but also help protect against errors or fraud when dealing with unfamiliar users.

1. For Easy Transactions

You can think of a phone number on Cash App as a shortcut for sending and receiving money. It eliminates the need to remember or search for $Cashtags or emails every time. When the recipient’s number is saved in your phone, Cash App automatically identifies them if they have linked their account. This reduces the risk of sending funds to the wrong person.

It’s especially helpful in recurring transactions, such as paying rent, splitting bills, or reimbursing friends. The number acts as a direct connection between both accounts, ensuring the payment goes exactly where it should. Instead of entering random identifiers, users can simply select from contacts and confirm. In several cases, this small detail speeds up the process, reduces typing errors, and simplifies daily financial interactions, making digital transactions more efficient overall.

2. For Contact Verification

It’s not just convenience that matters; verification plays an equally vital role. Fraudsters often create fake $Cashtags or mimic usernames to trick others into sending money to the wrong accounts. A confirmed phone number, however, ties a Cash App account to a real, verified identity. When you’re dealing with a new contact or business, this ensures authenticity.

It becomes much easier to confirm that the person receiving your funds is legitimate. Furthermore, Cash App uses phone numbers as verification tools when confirming user ownership. If you’re ever uncertain about a transaction, cross-checking the phone number with the recipient provides an additional layer of confidence. It’s a small detail that prevents big mistakes and strengthens trust within digital financial interactions.

3. For Security and Recovery

You can also see how critical a phone number becomes when it comes to account safety. If your Cash App account gets locked or you lose access, your linked number helps verify your identity instantly. This connection allows password resets, recovery codes, and two-factor authentication messages to be sent directly to your phone.

In the absence of this link, recovery becomes complicated, requiring manual support verification. Cash App uses the phone number as a bridge between your account and identity, ensuring that only authorized users can regain control.

It also sends alerts when suspicious logins occur, giving users immediate notice. Without it, important notifications might go unnoticed. So, a registered phone number is not just a contact method; it’s a safeguard that ensures account continuity, protects funds, and helps prevent unauthorized access.

4. For Communication and Requests

It often happens that users need to clarify payment details, send reminders, or coordinate transactions. A linked phone number makes all this easier through Cash App’s built-in messaging or notification system. You can directly message a contact, confirm amounts, or follow up about pending transfers.

In group settings—such as splitting expenses for trips or household costs—having everyone’s number connected streamlines requests. It also ensures faster communication without needing to switch between messaging apps or emails. In professional or freelance arrangements, having verified phone numbers for clients or partners fosters smoother exchanges and prevents misunderstandings.

Cash App thus becomes more than just a money transfer app; it becomes a communication channel.

Frequently Asked Questions:

Cash App hides users’ private details by default. Many people don’t list their phone numbers publicly for safety reasons. Even verified users often rely on $Cashtags or emails instead. If you can’t see the number, it’s because they’ve chosen not to share it. You can still contact them through the in-app message feature or by using their $Cashtag for transactions instead of relying on direct phone contact.

Yes, you can. Cash App allows messaging between users linked through transactions or $Cashtags. You can open a past payment or request, tap on the contact’s profile, and use the built-in chat feature. This is safer than exchanging personal numbers, especially with new contacts.

If you sent money to the wrong account, open the Cash App activity tab and find the transaction. Use the “Request Refund” option immediately and explain the mistake in the note. If the recipient doesn’t respond, contact Cash App support through the Help section. Provide the transaction ID, date, and amount. Cash App can’t guarantee recovery, but may assist in investigating or freezing the recipient’s account if fraud is suspected.